As a nonprofit professional, your top priorities day-to-day are likely fundraising and development. These activities are critical for your organization to thrive—after all, you can only serve your community and further your mission if you have the necessary support base and resources!

However, ensuring financial compliance should also be a priority for your nonprofit. Managing your organization’s funding according to legal requirements and industry standards allows your nonprofit to prove its trustworthiness and avoid penalties, ensuring you can continue to operate, deliver services, and retain the support you’ve worked hard to secure.

In this guide, we’ll walk through four key areas of financial compliance that all nonprofit professionals should be familiar with when performing everyday responsibilities. Let’s dive in!

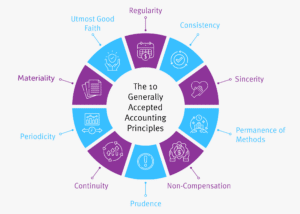

1. Generally Accepted Accounting Principles

The Generally Accepted Accounting Principles (GAAP) are a set of agreed-upon standards that govern all accounting practices for U.S. organizations, both for-profit and nonprofit. Their purpose is to standardize the recording and reporting of financial information across all sectors to ensure consistency and comparability in financial management.

The 10 GAAP standards your nonprofit’s team should know are as follows:

- Principle of Regularity: Ensures account structures adhere to uniform regulations.

- Principle of Consistency: Standardizes the types of financial reports organizations prepare.

- Principle of Sincerity: Promotes accuracy and impartiality in accounting practices.

- Principle of Permanence of Methods: Standardizes financial reporting procedures.

- Principle of Non-Compensation: Directs organizations to report all aspects of their financial situations (both positive and negative).

- Principle of Prudence: Ensures financial data isn’t influenced by speculation.

- Principle of Continuity: Assumes the organization’s operations will continue, which is reflected in financial reports.

- Principle of Periodicity: Standardizes the financial reporting schedules of fiscal years, quarters, and months.

- Principle of Materiality: Ensures financial reports fully disclose an organization’s financial situation.

- Principle of Utmost Good Faith: Assumes everyone involved in accounting is acting honestly.

These principles are especially important for nonprofits like yours for two key reasons. First, they help your organization be truthful and transparent in its financial reporting, which helps maintain donors’ trust. Second, you likely receive many types of monetary and non-cash gifts, and GAAP helps you account for all of them accurately and consistently.

2. Annual Tax Filings

If your nonprofit is registered as a 501(c)(3) organization, it’s exempt from federal and state income tax. However, this doesn’t mean you can sit back and relax come tax season! Instead, make sure your organization completes the following tax forms:

- IRS Form 990. This is the federal tax return for exempt organizations, which is due on the 15th day of the fifth month after your nonprofit’s fiscal year ends (May 15 if you use the calendar fiscal year). There are four versions of this form: 990-N for small nonprofits, 990-EZ for mid-sized organizations, the full Form 990 for large nonprofits, and 990-PF for any size private charitable foundation.

- State-specific tax forms. In addition to your federal tax return, some state governments (such as California and New York) require additional filings for your nonprofit to remain exempt from income tax in the state it operates in. However, some states (like North Carolina) just ask for a copy of your organization’s Form 990, and others (like Ohio) want to see your nonprofit’s annual report to check for financial compliance.

- Employer tax forms. Your nonprofit also needs to complete individual tax forms for its staff members by January 31 of each year. Every employee on your payroll should receive a W-2 reporting their salary and withholdings for the year, and you’ll file a 1099 for any contractors you pay at least $600 per year to do special projects for your organization.

Filing all of these tax forms correctly and on time demonstrates your nonprofit’s commitment to financial accountability to the government year after year. Plus, your team members will appreciate having access to their W-2s and 1099s well before their individual tax filing deadline on April 15.

3. Financial Audits

When most people hear the word “audit,” they shudder to think of IRS officials picking through their personal or business financial documents with a fine-toothed comb. However, while the IRS occasionally audits exempt organizations, most nonprofit financial audits are conducted independently. With this type of audit, you’ll contract a third-party auditor to provide an objective perspective on your organization’s financial health by reviewing your records and reports.

According to Jitasa’s nonprofit audit guide, there are four situations in which your nonprofit may be required to conduct an independent financial audit:

- Recurring audits are written into your organization’s bylaws.

- You receive more than $750,000 in federal funding per year.

- Your total annual revenue exceeds your state’s nonprofit audit threshold (usually $500,000).

- A grantmaker asks you to submit an audit report along with your grant application.

Even if your nonprofit doesn’t meet any of these requirements, you might still choose to undergo an independent financial audit annually or every few years to get a better sense of your organization’s strengths and improvement opportunities in financial management. If you don’t have the time or budget to hire an external auditor, you could also conduct an internal review of your financial records and reports to assess your situation and resolve any discrepancies.

4. Risk Management

Although no one wants to imagine their organization encountering risky situations or going through crises, it’s still important to be prepared if these issues arise so you can continue to manage your finances properly. Plus, financial noncompliance is a risk in itself—your nonprofit may face financial penalties for completing requirements late or incorrectly, and major compliance violations (such as failing to file Form 990 for three consecutive years) can cost your organization its 501(c)(3) status.

Here are a few other common risks associated with nonprofit finance and some strategies to manage them:

- Fraud. While some cases of nonprofit fraud occur because of bad actors’ intentional actions, others happen by accident. To prevent unintentional fraud and catch purposeful fraud early, implement internal controls, which are financial procedures designed specifically for risk management. For example, you might require two people to sign off on payments over a certain amount to double-check that they’re correct.

- Theft. If internal systems are faulty or individuals gain access to resources they shouldn’t, it can lead to situations where someone close to your nonprofit steals its money or assets. Mitigate this risk by developing clear access and management guidelines for various elements of nonprofit finance, such as rules for using your organization’s credit card and policies for reimbursing employee expenses.

- Data security. Your nonprofit’s various software solutions contain a lot of sensitive financial data related to your organization and its supporters. Double the Donation recommends protecting that data from breaches by encrypting your databases, limiting user permissions, and regularly updating your systems.

Clearly communicating with your nonprofit’s supporters and stakeholders is essential to effective risk management as well. Knowing that you have plans in place to mitigate potential problems and being transparent about how you handle any issues that still happen reinforces their trust in your organization, protecting your relationships and reputation.

By following the tips above, your organization can lay a solid foundation for financial compliance and more effective management of its funds. However, nonprofit requirements can be complicated to track and follow, so don’t hesitate to reach out to financial professionals if you need help or have any questions.