Let’s start with the name: The One, Big, Beautiful Bill.

It reads more like a marketing gimmick than public policy. But the “One, Big, Beautiful Bill” carries serious implications for nonprofits, and not the good kind.

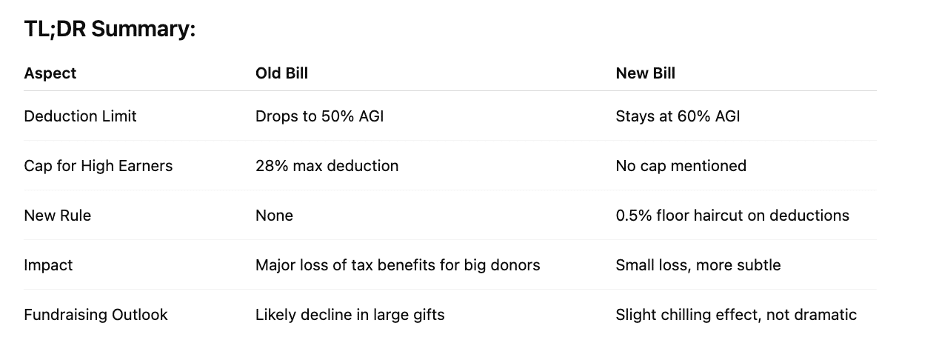

Released on June 16, the revised Senate tax bill proposes (another) massive shift in how charitable giving is treated.

Several of the most troubling provisions from the House were ultimately cut from the bill, but their quiet inclusion is telling. Proposals like a 10-year ban on state AI rules, new powers to revoke nonprofit status, a steep foundation tax, and the return of the “parking tax” may be gone for now, but they reveal how vulnerable the sector remains.

And while the rhetoric points to growth, fairness, and economic relief, the fine print tells a different story. It quietly redirects an estimated billions away from the nonprofit sector over the next decade. That’s not a rounding error. That’s enough to fund thousands of food banks, schools, and clinics.

There are certainly a few bright spots in the bill. But overall, it once again places the burden on nonprofits to do more with fewer resources. Let’s break down what’s included, how it might impact your donors, and how we can respond strategically—without losing our momentum or focus.

A Little Relief for Everyday Donors

Let’s begin with the good news—short and sweet. The bill revives and slightly improves the above-the-line charitable deduction for non-itemizers. In plain speak: everyday donors can now deduct up to $1,000 (or $2,000 for joint filers) even if they don’t itemize their taxes.

It doesn’t apply to gifts to donor-advised funds or supporting organizations, and it’s not as generous as what we saw during the pandemic. But it’s something. And in fundraising, sometimes a little incentive can go a long way in re-engaging those lower-dollar supporters who fell off after the 2017 tax changes.

If you’re working on year-end campaigns, this is a great time to say: “Your gift counts. Literally.”

For Major Donors? It’s… Complicated

Now here’s where things get trickier.

While the bill keeps the higher AGI limit for charitable deductions (60% of income for cash gifts), it also adds a twist: a 0.5% “floor” for itemizers. That means a donor has to subtract 0.5% of their income before calculating their deduction.

For most people, that’s not a dealbreaker. But for high-dollar givers—especially those thinking about a multi-six-figure pledge—even a small disincentive can affect timing and size.

We’re not saying people won’t give . But let’s be real: tax incentives can be part of the psychology for many donors. This move, subtle as it is, may cause hesitation – especially when combined with the microscope on some of their private foundations and general uncertainty right now.

Fundraisers, this is the time to lean in even more on impact storytelling. If you haven’t already prepared to address questions like “Is the tax benefit still worth it?,” now’s the moment to get ready.

The Corporate Clause That Could Shrink Local Giving

Let’s zoom out a bit. The bill also targets corporate charitable deductions, and not in a good way.

It introduces a 1% floor, meaning that only gifts totaling at least 1% of a corporation’s taxable income would be deductible. At first glance, that sounds like a minimum requirement—a nudge to give more.

But here’s the deal: it’s actually a cap in disguise. If a small business gives $10,000 but doesn’t meet the 1% threshold, it gets zero tax benefit. That could absolutely chill giving from local companies—insurance firms, restaurant groups, regional banks—the folks who fund your community stage or youth program.

And with $36 billion in corporate giving recorded last year, this is a channel we cannot afford to lose.

Endowments Under the Microscope

The bill also reshapes how large college and university endowments are taxed. Right now, there’s a flat 1.4% excise tax on investment income. The new structure adds tiers:

- 1.4% if the per-student endowment is under $750K

- 4% if it’s between $750K and $2M

- 8% if it’s over $2M

Supporters say this ensures the wealthiest schools put more of their resources to use. But many mid-sized private colleges, those that fuel regional economies and provide real access to students, could end up squeezed.

And it’s not just about tuition, these schools often host research centers and medical hubs. Redirecting or delaying their funds could slow everything from cancer studies to scholarships.

Nonprofit Compensation: A Costly Expansion

Next, let’s talk executive pay.

Currently, nonprofits face a 21% excise tax on salaries over $1 million for their top five earners. The new bill expands that to anyone over the threshold.

This includes coaches, surgeons, investment officers—any high-comp specialist in a nonprofit setting. And while it might seem like an easy public win, it creates another layer of complexity (and cost) for nonprofits trying to remain competitive in hiring.

You want the best people? You have to pay for them.

Meanwhile, Demand Is Climbing

All of these changes come at a time when need is surging.

The bill proposes major cuts to SNAP and Medicaid, which means millions may soon face food insecurity or lose health coverage. And that burden? It’ll fall directly on nonprofits.

Add to that the recent collapse of AmeriCorps funding, a blow that eliminated over 32,000 service positions, and we’re staring down a perfect storm:

- Increased demand

- Fewer hands on deck

- Tighter dollars

- And more red tape

If it feels like you’re carrying the weight of a system that keeps shifting beneath you, you’re in good company.

So What Do We Do With All This?

Well, first: don’t panic. But don’t shrug either.

This is a wake-up call. And not just for CFOs and policy folks. For boards. For program leads. For the person writing your thank-you notes.

Here’s where to start:

- Educate your people. Share what’s changing and why it matters.

- Get nimble. Revisit your funding projections and diversify where you can.

- Watch donor behavior. Don’t assume status quo. Let real-time data guide you.

- Reconnect with lapsed donors. This might be the moment they lean back in.

- Rethink your corporate asks. Focus on community visibility, not tax perks.

- Support your board. Equip them to talk about this with clarity and confidence.

A Few Common Pitfalls

This isn’t just about a shift in tax deductions—it’s a reflection of our collective priorities.

Nonprofits aren’t a nice-to-have. They’re the way millions of people access food, care, safety, and community. But this bill treats the sector as if it’s expendable.

We can—and must—push back. But we also need to get ready.

Because even when funding contracts, our missions don’t. The more prepared we are—strategically, emotionally, and operationally—the better equipped we’ll be to navigate this shift without compromising our values or our impact.

This work isn’t easy—but it’s always worth it.

FYI/REMOVED from Bill

AI Moratorium: A Quiet, Alarming Add-On

Buried in the bill is a 10-year federal ban on state-level AI regulations. That means states can’t pass laws about how AI is used in hiring, housing, or other areas—even as nonprofits increasingly adopt these tools.

This affects equity. It affects accountability. It affects how nonprofits can safely and ethically use tech. And it’s been added in with little debate.

H.R. 6408 and the Weaponization of Oversight

While the final bill removed a provision allowing the Treasury Secretary to revoke a nonprofit’s tax-exempt status based on alleged ties to terrorism, similar language still exists in H.R. 6408, currently in the Senate.

This is deeply concerning. It creates potential for politically motivated enforcement, places the burden of proof on nonprofits, and undermines the sector’s independence.

Foundations: Taxed and Tied Up

Now for the whiplash. The bill proposes a progressive excise tax on large private foundations—starting at 1.39% and jumping to as high as 10% for those with assets over $5 billion. That’s a huge leap.

Why does that matter? Because foundations provide nearly a fifth of all annual giving in the U.S. (about $103 billion in 2023). Redirecting billions away from their grantmaking means nonprofits, already hit by inflation, federal funding cuts, and soaring demand, have one less partner to lean on.

The Elephant (or Megachurch) in the Room

Here’s where things get spicy. The bill introduces new rules, taxes, and oversight for all kinds of nonprofits—but explicitly exempts religious institutions. That includes churches, many of which are exempt from filing Form 990s and hold significant assets. In 2022, religious orgs received $135 billion in donations.

And yet? No new scrutiny. No new taxes. No matching disclosure requirements. If you’re wondering why, so are we.

The Return of the Parking Tax

It also brings back the much-hated “parking tax,” treating transit benefits as taxable unrelated business income.